Unlock your potential in investing with Stratta

Expert guidance and proven strategies to navigate financial markets successfully

About

At Stratta, we're dedicated to revolutionizing the way everyday investors approach the financial markets.

Our experienced team delivers consistent, double-digit returns, earning your trust through transparency and a proven track record.

Our Services

What we do

01

Alternative Fund Management

We design, launch, and manage specialized investment funds across private credit, real estate, and alternative markets. Each fund is built with a focus on risk-adjusted returns, asset security, and long-term performance.

02

Capital Preservation, Growth & Risk Mitigation

Our investment strategies are engineered to preserve capital, generate steady returns, and mitigate risk through asset-backed structures, conservative underwriting, and disciplined portfolio management. Every opportunity is evaluated with downside protection as a core priority.

03

Access to Private Markets

We open the door to institutional-grade investment opportunities typically reserved for hedge funds, family offices, and ultra-high-net-worth investors — offering a new level of access, transparency, and control.

Blog

Insights & Analysis

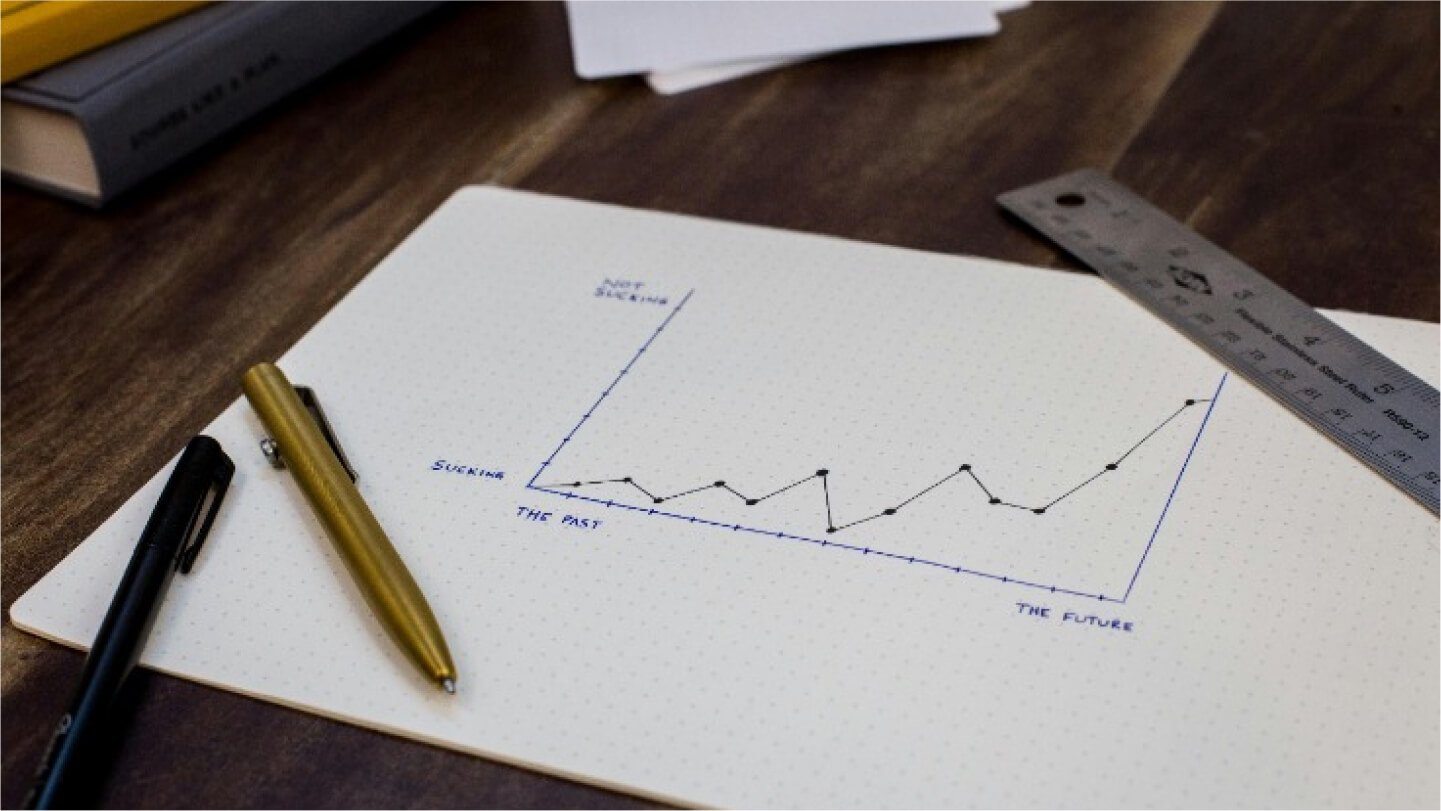

Stratta makes investing easy

1. Meet With The Team

2. Sign Documents

3. Invest

4. Collect

"I have been relying on Stratta portfolio management services for several years now, and I couldn't be happier with the results. Their team of experts took the time to understand my financial goals and risk tolerance, creating a customized investment strategy that has consistently outperformed the market."

Mark Johnson

Investor

F.A.Q.

Find answers to commonly asked questions about our services

What types of funds does Stratta manage?

Stratta manages a range of alternative investment funds, starting with our Private Credit Fund, which focuses on short-term, asset-backed real estate loans. In the future, we plan to expand into other strategies including business credit, value-add acquisitions, and opportunistic private market opportunities. Each fund is structured with disciplined underwriting and risk management at its core.

Is my investment secured by any collateral?

Yes. Our Private Credit Fund is backed by real estate assets, typically secured through first-position liens and conservative loan-to-value (LTV) ratios. Each loan is underwritten in-house and reviewed for asset quality, borrower strength, and downside protection, ensuring investor capital is safeguarded with real assets.

What makes Stratta different from other investment firms?

Stratta combines institutional-grade discipline with entrepreneurial agility. We focus on building efficient, performance-driven funds that provide access to private market strategies once reserved for institutional investors. Every fund is designed with transparency, capital preservation, and investor alignment at its core — and our leadership invests alongside our clients.